Cars market price reports deliver updates and analyses of new and used car pricing trends within the US automotive market. Utilizing extensive data from hundreds of thousands of vehicle listings, these auto market price reports provide in-depth insights into pricing fluctuations and emerging market patterns.

Understanding price trends is crucial for buyers, sellers, and dealers. Buyers can identify fair market prices to make informed purchases and negotiate better deals. Sellers can set competitive prices to attract buyers and maximize returns. Dealers can manage inventory and anticipate market shifts to stay competitive. These reports, featuring car market price graphs and predictions, enhance transaction transparency and equity, while car price news provides stakeholders with actionable market intelligence.

Understanding price trends is crucial for buyers, sellers, and dealers. Buyers can identify fair market prices to make informed purchases and negotiate better deals. Sellers can set competitive prices to attract buyers and maximize returns. Dealers can manage inventory and anticipate market shifts to stay competitive. These reports, featuring car market price graphs and predictions, enhance transaction transparency and equity, while car price news provides stakeholders with actionable market intelligence.

New Car Market Price Trends

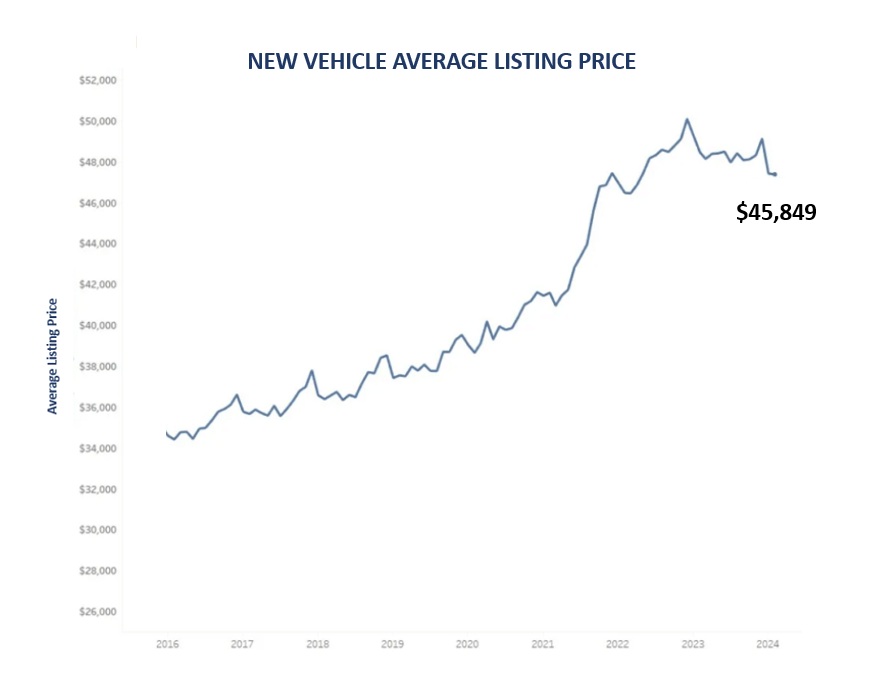

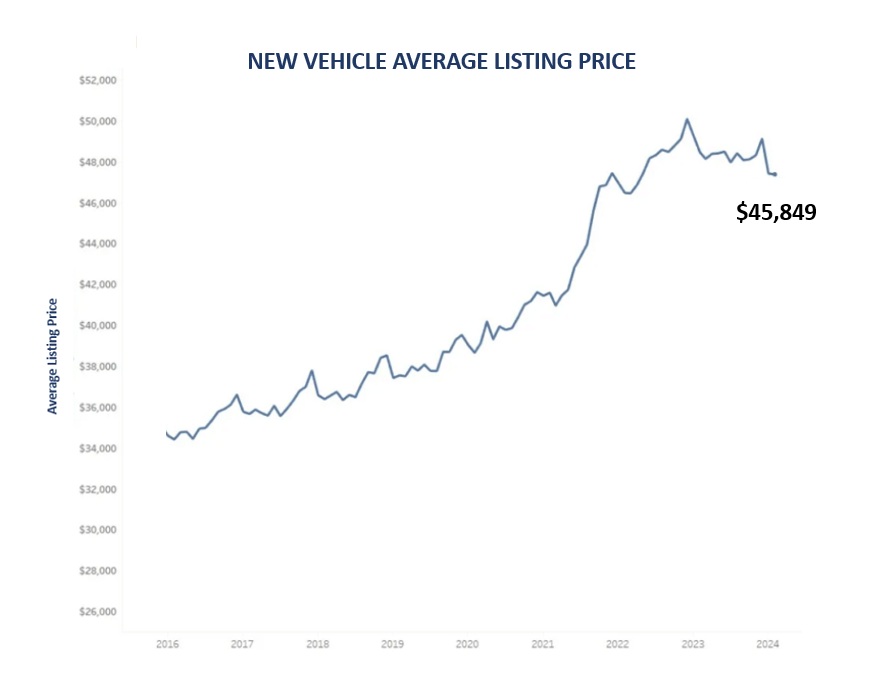

From January to May 2024, the new car market has experienced notable trends in pricing and inventory, reflecting broader economic influences and industry adjustments.

Inventory levels are increasing, with the current supply at around 76 days, compared to 86 days pre-pandemic. Some brands, like Toyota and Subaru, still have limited stock, contributing to higher prices for their models. Conversely, brands like Jeep, Ram, and Alfa Romeo have an abundant supply, making it a buyer’s market for these vehicles

Stabilizing Prices

After years of significant increases, new car prices are beginning to stabilize. The average listing price of new non-luxury vehicles saw a modest rise, reaching about $45,849 by April 2024, a less than 1% year-over-year increase. However, the market is showing signs of correction, with some car prices decreasing.Increased Inventory

Inventory levels have improved significantly, with an 80-day supply of new cars on dealer lots as of April 2024, compared to the typical 60-day supply. This surplus has prompted dealers to offer more incentives and discounts, benefiting consumers.Inventory levels are increasing, with the current supply at around 76 days, compared to 86 days pre-pandemic. Some brands, like Toyota and Subaru, still have limited stock, contributing to higher prices for their models. Conversely, brands like Jeep, Ram, and Alfa Romeo have an abundant supply, making it a buyer’s market for these vehicles

Economic Influences

High but slowly declining inflation and sustained high interest rates are influencing car prices and consumer purchasing power. Despite high interest rates, dealers are offering more competitive loan and financing deals. Incentive spending averaged 5.7% of the selling price in January 2024, nearly doubling from the previous year.Brand-Specific Trends

Some brands, like Toyota and Subaru, have seen price increases due to lower inventory levels. Toyota had a 44-day supply and Subaru an 86-day supply, making them exceptions in a market with generally increasing inventories.Used Cars Market Price Trends

The used car market has seen some price adjustments. For instance, SUV prices have decreased by more than 7% from the previous year, while non-luxury cars have seen a smaller decrease of 1.7%. Despite these declines, there have been recent modest increases in prices for luxury SUVs and cars, indicating a potential stabilization or slight upward trend in certain segments.

Here’s a comprehensive look at the current trends:

Here’s a comprehensive look at the current trends:

Overall Price Trends:

- Decline in Prices: Used car prices have been falling from their peak levels during the pandemic. Prices are currently down about 17% from the high in May 2022, with further declines expected throughout 2024. Moody’s Analytics forecasts an 8.1% drop in used car prices this year.

- Recent Fluctuations: While there has been a general downward trend, there have been some short-term price increases. For instance, prices slightly rose by 0.06% from December 2023 to January 2024 before resuming their decline.

Vehicle Type Variations:

- Electric Vehicles (EVs): The supply of used EVs has increased significantly, with transactions up 80% year-over-year. Price corrections have made EVs more competitive with traditional internal combustion engine vehicles, driving up demand.

- Body Styles: Different vehicle types are experiencing varied price trends. For example, hatchbacks and vans saw significant year-over-year price drops of 10.19% and 12.48%, respectively. SUVs and crossovers also declined by around 8-9%.

Supply and Inventory:

- Improved New Car Supply: The increase in new car production has eased pressure on the used car market, contributing to the price declines. As new cars become more readily available, demand for used cars has decreased.

- Shortage of Mid-Age Vehicles: There is a notable shortage of three to five-year-old used cars due to reduced new car sales during the pandemic. This has kept prices for this segment relatively high.

Interest Rates and Financing:

- High Interest Rates: High interest rates on used car loans, often above 14%, have deterred potential buyers, contributing to lower demand and falling prices.

Consumer Behavior:

- Demand for Budget Vehicles: There is strong demand for older, more affordable used cars, particularly those priced under $20,000. This segment has appreciated more rapidly than newer used cars.

- Digital and Physical Sales: While online sales platforms remain popular, there is a growing trend toward omnichannel retailing, combining online and physical dealership experiences to cater to consumer preferences for in-person vehicle inspections.

Electric Vehicles (EVs) and Hybrids Market Price Trends

The market for electric vehicles (EVs) and hybrids in 2024 is expected to show significant growth and evolving trends, driven by advancements in technology and increasing consumer demand. EV sales are projected to rise steadily, with battery-electric vehicles (BEVs) and plug-in hybrids continuing to gain market share. Despite some concerns about inventory build-up, overall sales are expected to increase, with estimates suggesting EVs could make up over 10% of total vehicle sales in the U.S. in 2024. This growth is facilitated by decreasing prices and improved affordability, as technological advancements like Ideal Power’s B-TRAN and improvements in battery technology reduce production costs and enhance vehicle range.

Hybrid vehicles are also contributing to this trend, with a combined market share of hybrids, plug-in hybrids, and BEVs reaching 16.3% of total new light-duty vehicle sales in the U.S. in 2023. This segment is expected to grow further as manufacturers continue to innovate and introduce new models. Solid-state battery technology is anticipated to play a crucial role in the future, offering higher energy density and longer ranges, which could significantly alleviate range anxiety among potential EV buyers. Additionally, the adoption of Tesla’s charging plug by other automakers is expected to streamline the charging infrastructure, making it more accessible and user-friendly.

Hybrid vehicles are also contributing to this trend, with a combined market share of hybrids, plug-in hybrids, and BEVs reaching 16.3% of total new light-duty vehicle sales in the U.S. in 2023. This segment is expected to grow further as manufacturers continue to innovate and introduce new models. Solid-state battery technology is anticipated to play a crucial role in the future, offering higher energy density and longer ranges, which could significantly alleviate range anxiety among potential EV buyers. Additionally, the adoption of Tesla’s charging plug by other automakers is expected to streamline the charging infrastructure, making it more accessible and user-friendly.

Car Market Prediction: Anticipating Stability and Incremental Growth

The car market in 2024 is anticipated to experience modest growth and increased stability. In the new car segment, inventory levels are recovering, leading to a projected 4% increase in sales, with around 1.97 million new cars expected to be sold. While prices remain high due to past supply chain disruptions, increased supply and competitive financing offers are helping to make new cars more affordable. Electric vehicles (EVs) continue to gain market share, driven by better charging infrastructure and consumer acceptance, though profitability concerns persist for manufacturers.

In the used car market, strong demand is expected to persist, with sales projected to rise slightly to 7.24 million units. While prices have softened somewhat, they are anticipated to stabilize rather than drop significantly, due to high consumer confidence and the impact of the pandemic on vehicle supply. Rising interest rates are increasing the cost of financing, which could temper demand in both markets. Innovations in online car retailing, such as Amazon’s partnership with Hyundai, and broader economic factors will continue to shape market dynamics in 2024.

In the used car market, strong demand is expected to persist, with sales projected to rise slightly to 7.24 million units. While prices have softened somewhat, they are anticipated to stabilize rather than drop significantly, due to high consumer confidence and the impact of the pandemic on vehicle supply. Rising interest rates are increasing the cost of financing, which could temper demand in both markets. Innovations in online car retailing, such as Amazon’s partnership with Hyundai, and broader economic factors will continue to shape market dynamics in 2024.

Stay Ahead of the Curve with Automotive Market Insights

Automotive Market Insights is a monthly report on the US automotive market, drawing from extensive data derived from hundreds of thousands of new and used vehicle listings. The report illuminates pricing shifts and emerging trends, providing actionable market intelligence for stakeholders. Sections covering inventory levels, national average prices, body type trends, and comparisons between listed and sold vehicles, offer valuable insights into market dynamics and consumer preferences, enabling informed decision-making.

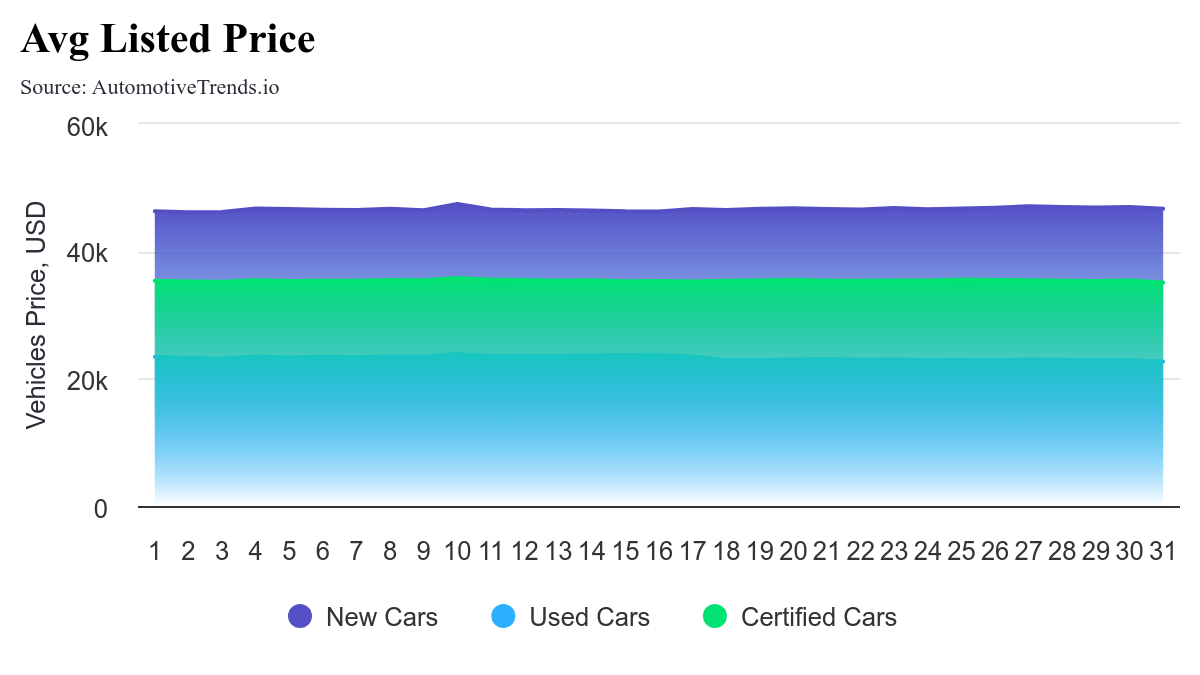

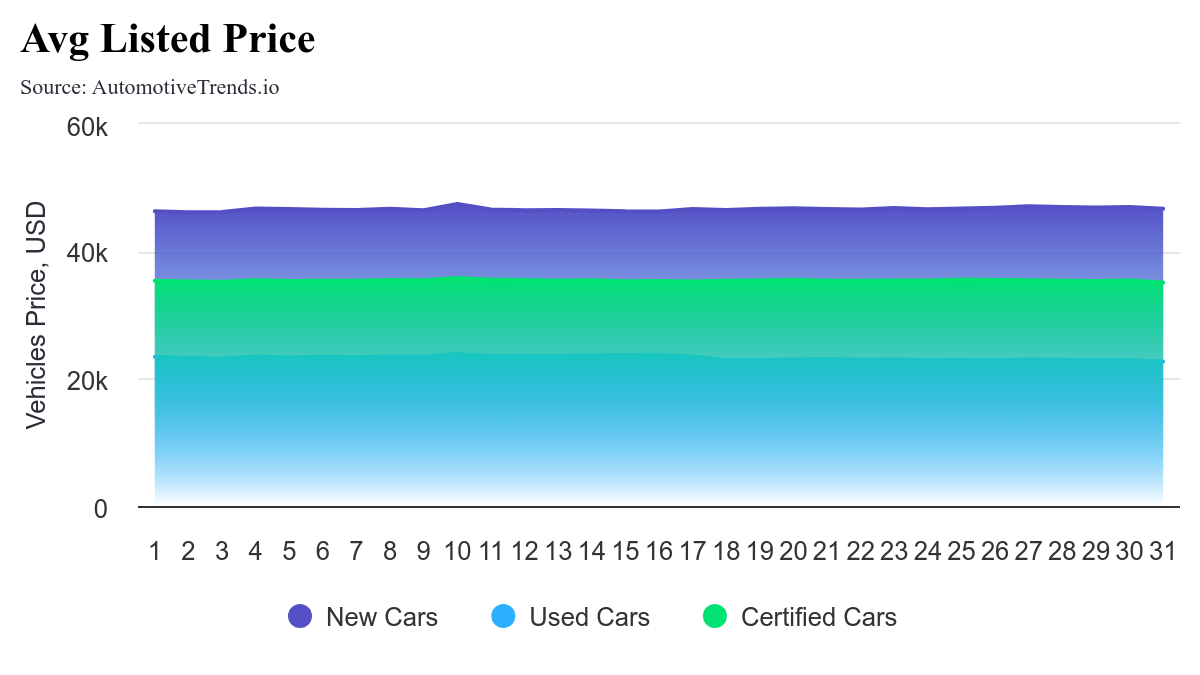

Here is a quick look at pricing trends based on the latest Automotive Market Insights reports:

Relatively stable pricing trends in March 2024, influenced by market competition or shifts in consumer demand. Prices increased in April 2024 slightly, indicating an improved market compared to the previous month.

To check how other aspects of the auto market performed in the same period, visit the Automotive Market Insights page.

Here is a quick look at pricing trends based on the latest Automotive Market Insights reports:

Relatively stable pricing trends in March 2024, influenced by market competition or shifts in consumer demand. Prices increased in April 2024 slightly, indicating an improved market compared to the previous month.

To check how other aspects of the auto market performed in the same period, visit the Automotive Market Insights page.