ELECTRIC VEHICLE MARKET INSIGHTS: TRENDS AND DATA FOR 2024

The electric vehicle market has been growing at a rapid pace, driven by technological advances, increasing consumer demand, and policy support. Industry forecasts predict continued expansion, with electric vehicles becoming a more prominent option for consumers worldwide.

Let’s explore the key drivers behind this market shift, along with emerging challenges and opportunities. This will help you stay informed and make smart decisions in the fast-evolving EV landscape.

EV Market by Vehicle Types

The EV market is rapidly transforming to meet growing global demand and adapt to local preferences. Electric trucks, buses, light commercial vehicles, and two- and three-wheelers are all playing distinct roles in reshaping the automotive world.

- Electric Trucks: According to Virta Global, sales grew by 35%, surpassing electric buses for the first time in 2023. Over 10,000 electric trucks were sold in Europe.

- Light Commercial Vehicles (LCVs): Sales grew by 50%, with China and Europe being the largest markets.

- Electric Buses: Global sales reached 50,000, with China still a major market and exporter despite declining domestic demand.

- Two and Three-Wheelers: These accounted for 13% of total sales in 2023, with a slight global decline in two-wheeler sales but growth in three-wheeler sales (30%).

EV Battery Production

While traditional internal combustion engine (ICE) vehicles continue to dominate the market, hybrids, plug-in hybrids (PHEVs), and fully electric vehicles (EVs) are swiftly gaining popularity. This shift in mobility stems from a growing awareness of environmental challenges, alongside government incentives that promote cleaner transportation options.

- Battery Demand: Increased by 40% in 2023 due to growing EV sales, particularly battery electric vehicles (BEVs) and plug-in hybrids (PHEVs).

- China’s Dominance: Leads in the production of battery materials, with 90% of active cathode and 97% of active anode material production globally.

- Europe’s Share: Expected to rise to 31% of global battery production by 2030.

- Battery Price Drop: Prices fell by 14% in 2023, largely due to falling prices of key metals like cobalt and manganese.

- Battery Recycling: Recycling capacity reached 300 GWh in 2023 and is expected to rise to 1,500 GWh by 2030, reflecting a push towards sustainability.

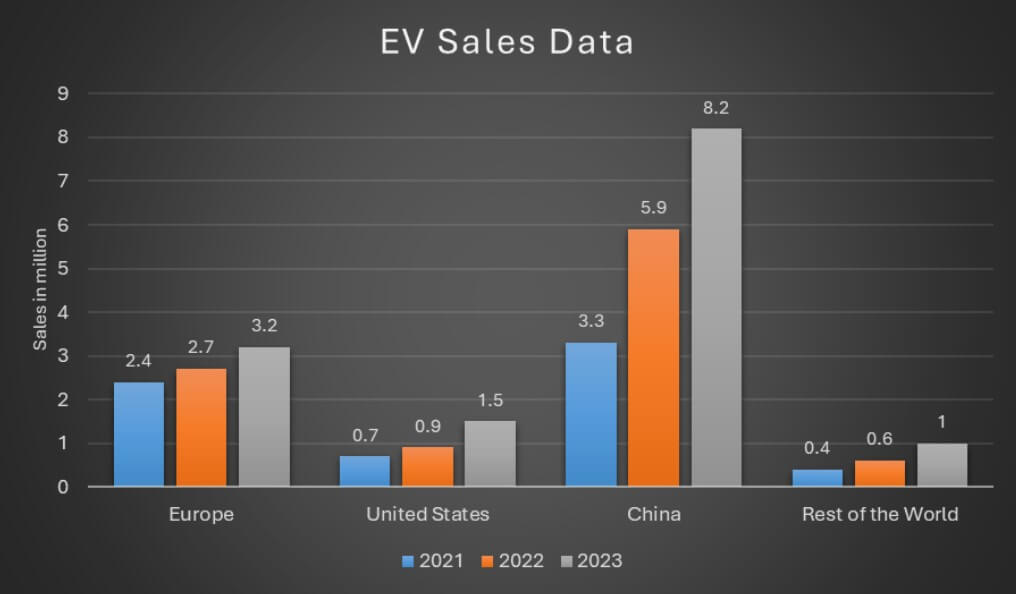

Regional EV Data Analytics (EV Sales Data)

Based on current EV sales data, the EV market has been growing rapidly across regions worldwide, with distinct trends in adoption influenced by local policies, infrastructure, and consumer preferences:

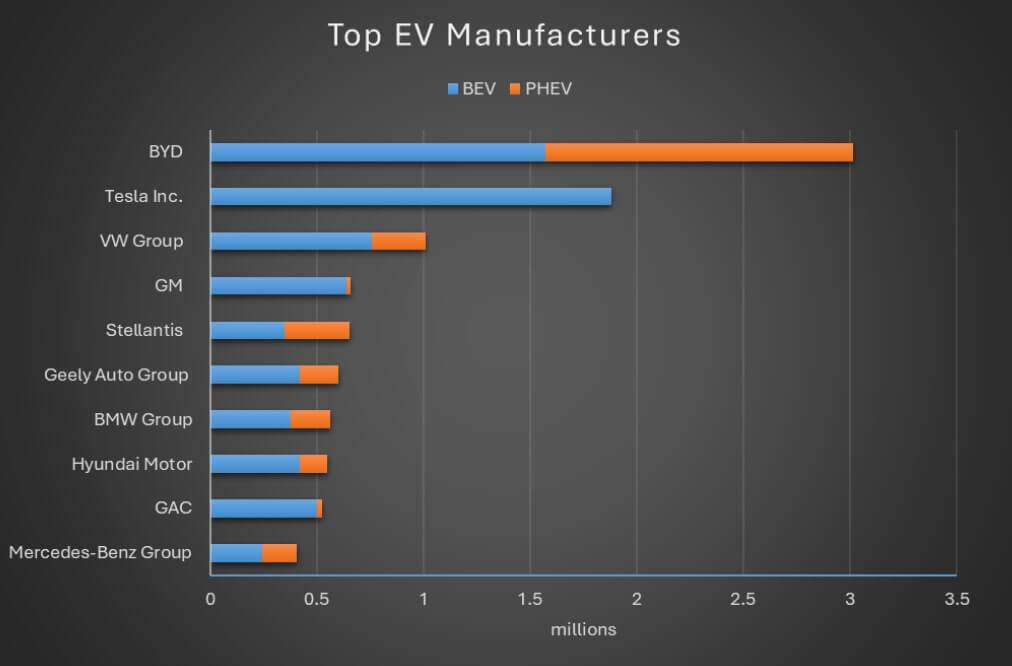

Leading Automakers Driving the Global Electric Vehicle Revolution

A select number of EV automakers are driving a transformative wave in the EV market. These industry trailblazers are redefining transportation’s future and fast-tracking the worldwide transition toward a cleaner, electrified world.

BYD

Founded in 1995 in Shenzhen, China, by Wang Chuanfu with just 20 employees, BYD has since grown into a global leader. BYD experienced tremendous growth in 2023, selling a total of 3,024,417 vehicles—a remarkable 61.8% increase from the previous year. Of these, nearly 1.6 million were fully electric vehicles, solidifying BYD’s position as a major player in the market for electric vehicles.

Tesla

Tesla remains the dominant player, holding an impressive 59.1% share of the U.S. battery electric vehicle (BEV) market in 2023. Tesla’s latest models, like the Model 3 and Model Y, continue to set benchmarks in range, performance, and technology. The company has maintained its leadership due to its strong brand and comprehensive charging infrastructure.

Volkswagen Group

Volkswagen Group is aggressively investing in EVs, with models like the ID.4 and Audi e-tron leading the charge. Volkswagen aims to make EVs a significant part of its sales, with plans for a robust charging infrastructure.

Nissan

Nissan is a pioneer in the EV space, thanks to the Nissan LEAF, one of the first mass-market electric cars introduced in 2010. Nissan expanded its portfolio with the launch of the Nissan ARIYA, a stylish electric crossover with a longer range.

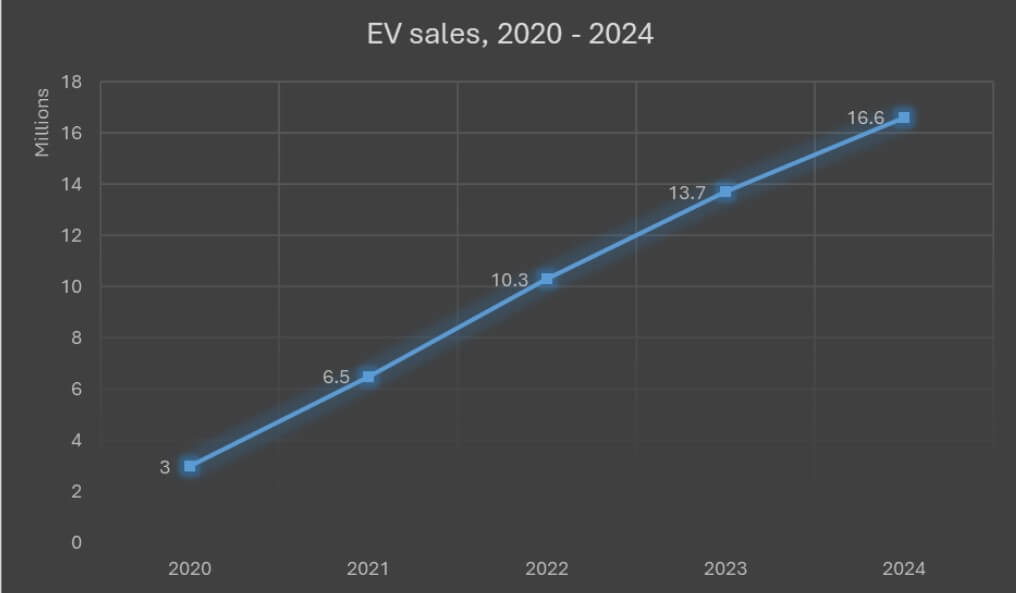

Historical Growth and Projections in EV Sales

With each passing year, new milestones in EV adoption have been reached, even in the face of obstacles like the COVID-19 pandemic and supply chain disruptions. What started as steady progress in 2020 has accelerated into rapid growth, with EV sales gaining momentum at an impressive rate.

- 2020: Despite a challenging year due to COVID-19, global EV sales grew by 43%, with EVs accounting for 4.6% of new car sales.

- 2021: EV sales doubled from 2020, reaching 6.75 million, and marked a significant leap in the global adoption of electric cars.

- 2022: EV sales exceeded 10 million, with 14% of new car sales being electric, up from 9% in 2021. The total number of electric cars on the road grew to 26 million, representing a 60% increase from 2021.

- 2023: EV sales reached nearly 14 million, a 35% increase from 2022, raising the global EV fleet to 40 million. By the first quarter of 2024, sales grew by 25% year-on-year.

- 2024: Sales are expected to reach 17 million, with EVs projected to account for 20% of total car sales. Growth outside core markets (China, Europe, and the USA) is expected to accelerate.

Government Incentives and Regulations

Governments worldwide are ramping up efforts to transition to electric vehicles (EVs) as part of broader initiatives to reduce carbon emissions and combat climate change. The European Union has established strict emission standards, limiting CO₂ emissions for passenger cars to 95 grams per kilometer, which forces automakers to develop zero-emission EVs. Similarly, China’s New Energy Vehicle (NEV) credit system requires manufacturers to accumulate credits through EV production or face penalties, contributing to China’s position as the largest EV market.

In Europe, countries like Norway, the Netherlands, and Germany offer significant tax reductions or exemptions for EV buyers, enhancing the financial appeal of electric cars. In the U.S., California’s Zero-Emission Vehicle (ZEV) program mandates that automakers sell a certain percentage of electric vehicles based on total sales, while federal tax credits of up to $7,500 incentivize consumers to purchase eligible EVs. However, some manufacturers, like Tesla and GM, have already reached the cap on these credits.

Additionally, various U.S. states provide further incentives, such as rebates and reduced registration fees. For example, California’s Clean Vehicle Rebate Project (CVRP) offers up to $7,000 in rebates for electric vehicle buyers, promoting broader EV adoption.

Environmental Impact of Electric Vehicles (EVs)

Electric vehicles are set to play a larger part in global sustainability initiatives, reducing emissions and enhancing energy storage capabilities. This advancement cements their status as a key player in the fight against climate change.