US Auto Industry Market Share in Focus

The U.S. car market is currently dominated by SUVs and crossovers, which hold the largest car market share due to their versatility and safety features. Meanwhile, electric vehicles (EVs) are experiencing rapid growth, driven by advancements in technology, expanded charging infrastructure, and supportive government policies. Major automakers like General Motors and Ford are increasingly focusing on EVs, alongside new entrants like Tesla and Rivian.

Key market trends include the rise of autonomous driving technology and enhanced vehicle connectivity, despite ongoing supply chain disruptions, particularly in semiconductor availability. Consumer preferences are shifting towards environmentally friendly options, contributing to the growing popularity of hybrids and EVs. The market is also influenced by stricter emissions regulations and economic factors such as rising interest rates and inflation, which affect vehicle affordability.

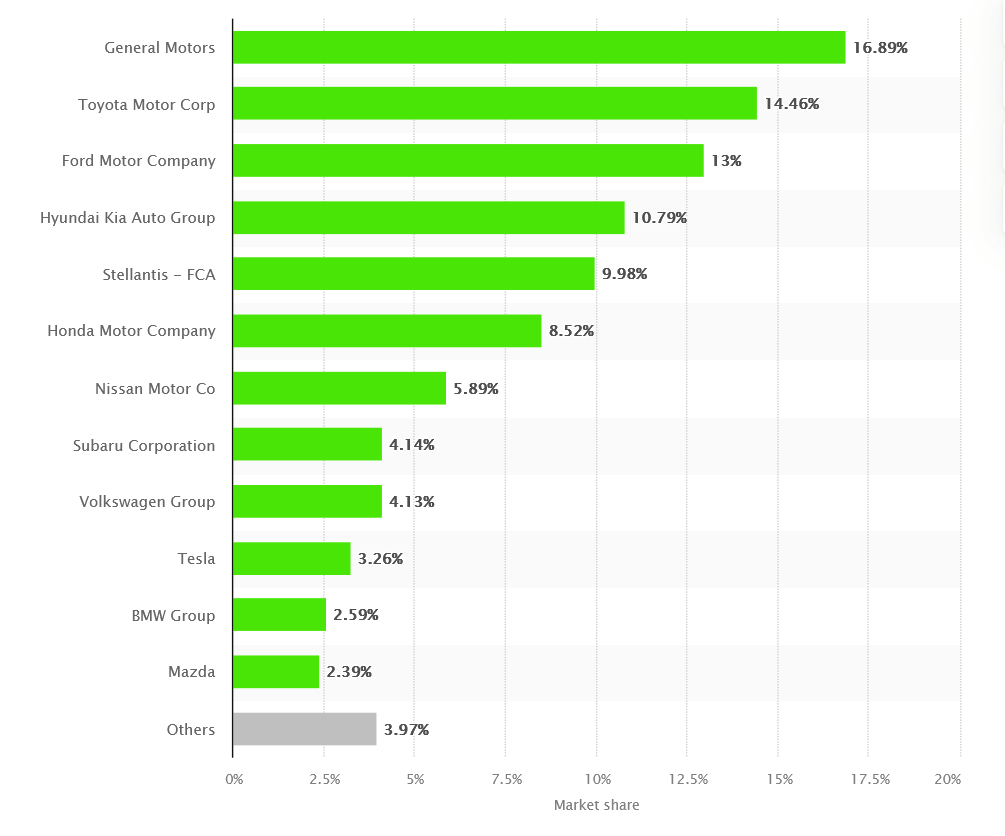

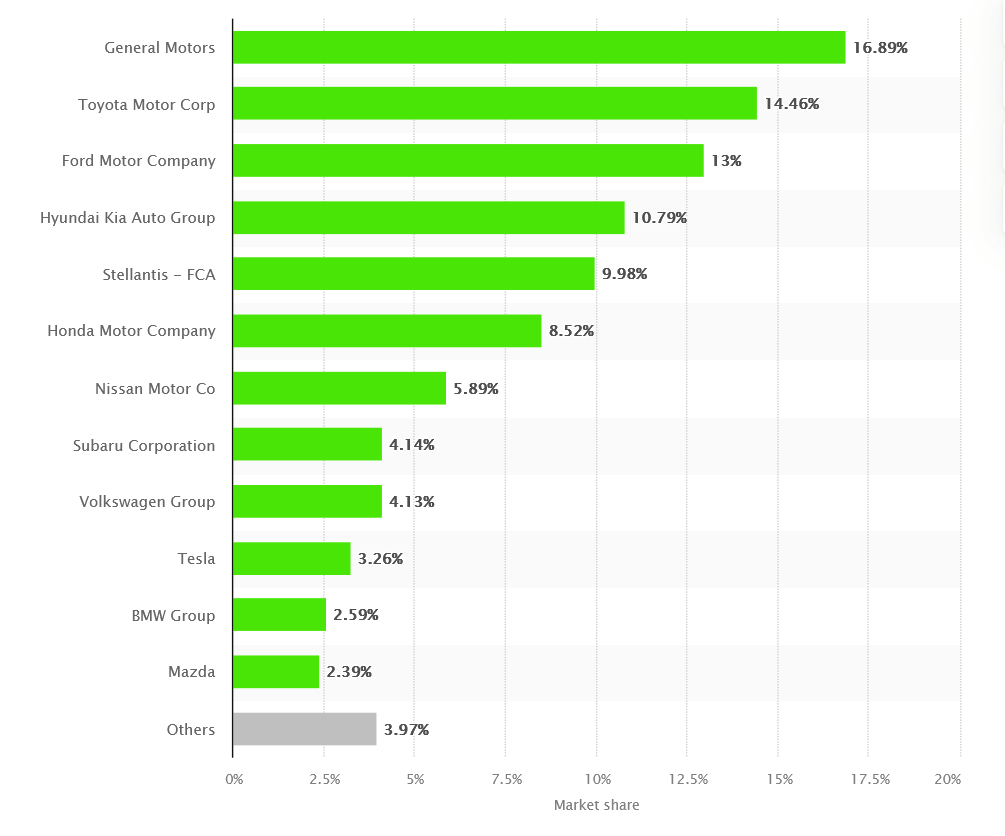

As of 2024, the U.S. car market is dominated by a few key manufacturers, each holding significant market share across various vehicle segments. The chart below highlights the top manufacturers and their respective market shares, reflecting current consumer preferences and industry trends.

In 2023, the US automotive market saw significant developments. General Motors emerged as the frontrunner, selling over 2.5 million vehicles and securing approximately 16.6% of the market share. Following closely behind was Toyota, with sales exceeding 2.2 million and a market share of about 14.5%. Ford showcased robust performance with nearly 2 million sales, capturing around 12.8% of the market. Hyundai-Kia and Stellantis completed the top five, each boasting substantial sales figures and market shares of 10.7% and 9.9%, respectively. These insights into the US automotive market shed light on the key players shaping the industry landscape and making significant impacts.

Key market trends include the rise of autonomous driving technology and enhanced vehicle connectivity, despite ongoing supply chain disruptions, particularly in semiconductor availability. Consumer preferences are shifting towards environmentally friendly options, contributing to the growing popularity of hybrids and EVs. The market is also influenced by stricter emissions regulations and economic factors such as rising interest rates and inflation, which affect vehicle affordability.

As of 2024, the U.S. car market is dominated by a few key manufacturers, each holding significant market share across various vehicle segments. The chart below highlights the top manufacturers and their respective market shares, reflecting current consumer preferences and industry trends.

Domestic Manufacturers:

- General Motors (GM):

- Continues to hold a substantial market share, particularly strong in the SUV and pickup truck segments.

- Expanding its EV lineup with models like the Chevrolet Bolt and upcoming electric Silverado.

- Ford Motor Company:

- A major player with a strong presence in trucks (F-Series) and SUVs.

- Significant investment in EVs, with popular models like the Mustang Mach-E and the F-150 Lightning.

- Stellantis (formerly Fiat Chrysler Automobiles):

- Market share driven by brands such as Jeep, Ram, and Dodge.

- Focus on SUVs and trucks, with emerging plans for EVs like the Jeep Wrangler 4xe.

- Tesla:

- Dominates the EV market share in the U.S., with popular models like the Model 3, Model Y, and Model S.

- Continues to lead in innovation and charging infrastructure.

Foreign Manufacturers:

- Toyota:

- One of the largest market shares among foreign automakers, known for reliability and fuel efficiency.

- Popular models include the Camry, Corolla, and RAV4, with a growing hybrid and EV lineup.

- Honda:

- Strong market share with popular models such as the Accord, Civic, and CR-V.

- Expanding presence in the hybrid and EV market with models like the Honda Insight and upcoming Prologue EV.

- Hyundai-Kia:

- Increasing market share with a broad range of vehicles from compact cars to SUVs.

- Notable for its competitive pricing and growing lineup of EVs, including the Hyundai Ioniq 5 and Kia EV6.

Market Share Insights:

- SUVs and Trucks: Domestic manufacturers like GM, Ford, and Stellantis dominate these segments.

- Electric Vehicles: Tesla remains the leader, but traditional automakers are rapidly catching up with new EV models.

- Sedans and Compact Cars: Toyota and Honda lead in this segment, though it has been declining in overall market share.

US Auto Market Share, 2023

| Automaker | Sales | Market Share |

| General Motors | 2,577,662 | 16.6% |

| Toyota Motor | 2,248,477 | 14.5% |

| Ford Motor | 1,981,332 | 12.8% |

| Hyundai-Kia | 1,652,821 | 10.7% |

| Stellantis | 1,533,670 | 9.9% |

What makes the top brands stand out from the crowd? Well, it’s all about understanding what makes them tick. Whether it’s their reputation for quality, innovative features, or savvy marketing strategies, these factors play a crucial role in their continued dominance in the market.

Take General Motors (GM), for example. With brands like GMC, Cadillac, and Chevrolet under its wings, GM has some seriously successful cars in its lineup. Buick, owned by GM, is making waves in initial quality rankings, sitting among the top contenders alongside brands like Dodge, Ram, and Alfa Romeo sold under Stellantis.

And let’s not forget about Toyota and its subsidiary, Lexus. While Toyota ranks second overall, Lexus claims the tenth spot in initial quality rankings and secures second place in overall US consumer satisfaction in 2023. These brands are pulling out all the stops to keep their customers satisfied and maintain their position at the top.

Take General Motors (GM), for example. With brands like GMC, Cadillac, and Chevrolet under its wings, GM has some seriously successful cars in its lineup. Buick, owned by GM, is making waves in initial quality rankings, sitting among the top contenders alongside brands like Dodge, Ram, and Alfa Romeo sold under Stellantis.

And let’s not forget about Toyota and its subsidiary, Lexus. While Toyota ranks second overall, Lexus claims the tenth spot in initial quality rankings and secures second place in overall US consumer satisfaction in 2023. These brands are pulling out all the stops to keep their customers satisfied and maintain their position at the top.

US Cars vs. the World: Trends & Rankings

Car sales in the US in 2023 were booming, with around 15.5 million light vehicle units (passenger cars and light trucks) hitting the roads. Brands like Toyota, Lexus, Tesla, and Cadillac scored big points with customers, keeping satisfaction levels high. And it’s not just in the US—worldwide, car sales were on the rise, reaching a whopping 75.3 million automobiles in 2023, up from 67.3 million units the previous year. That’s quite the jump!

Auto car sales in 2023 have managed to bounce back and even exceed pre-pandemic levels. This is great news for the auto industry which has been affected by the slowdown in the global economy and the disruptions caused by COVID-19 and conflicts in some parts of the world. It seems like the automotive world continues to rev up for more exciting times ahead.

These rankings paint a clear picture of the global automotive landscape, with China leading the charge and the US not too far behind.

The electric vehicle (EV) market is booming worldwide and in the US. According to estimates from Kelley Blue Book, 1,189,051 new EVs hit the roads in 2023. Their share in the total US vehicle market rose to 7.6% in 2023. Tesla remains the leader in EV sales, capturing 55% of the market in the same year. Lower prices are strengthening Tesla’s position as the undisputed champion of EVs in the U.S.

So, lots of people are ditching traditional rides for eco-friendly ones with cool tech features. And with government incentives making EVs even more tempting, this shift is a big deal for businesses in the automotive world. They’ve gotta step up their game by investing in EV tech to draw in eco-conscious customers and keep up with the competition. Plus, as EVs become more popular, it’s shaking up the demand for traditional cars. That means businesses have to rethink their strategies and shine a spotlight on the perks of non-EV models.

Auto car sales in 2023 have managed to bounce back and even exceed pre-pandemic levels. This is great news for the auto industry which has been affected by the slowdown in the global economy and the disruptions caused by COVID-19 and conflicts in some parts of the world. It seems like the automotive world continues to rev up for more exciting times ahead.

Top 5 markets by country based on total vehicle sales (units sold)

| Rank | Country | Total Vehicle Sales |

| 1 | China | 30,094,767 |

| 2 | United States | 15,604,278 |

| 3 | Japan | 4,779,639 |

| 4 | India | 4,108,263 |

| 5 | Germany | 2,845,764 |

The electric vehicle (EV) market is booming worldwide and in the US. According to estimates from Kelley Blue Book, 1,189,051 new EVs hit the roads in 2023. Their share in the total US vehicle market rose to 7.6% in 2023. Tesla remains the leader in EV sales, capturing 55% of the market in the same year. Lower prices are strengthening Tesla’s position as the undisputed champion of EVs in the U.S.

So, lots of people are ditching traditional rides for eco-friendly ones with cool tech features. And with government incentives making EVs even more tempting, this shift is a big deal for businesses in the automotive world. They’ve gotta step up their game by investing in EV tech to draw in eco-conscious customers and keep up with the competition. Plus, as EVs become more popular, it’s shaking up the demand for traditional cars. That means businesses have to rethink their strategies and shine a spotlight on the perks of non-EV models.

Wrap-Up: Making Sense of US Car Market Share

In a nutshell, staying on top of auto manufacturer market share in America is a big deal. It gives us the inside track on what’s trending, where the industry’s headed, and which brands are leading the charge. And when it comes to making decisions about cars or steering your business in the auto sector, having accurate vehicle data is a game-changer. This is why VinAudit’s vehicle data products are indispensable tools, offering automotive insights for operating in the industry with confidence.