Secure Your Vehicle Purchase: DMV Lien Check Made Easy

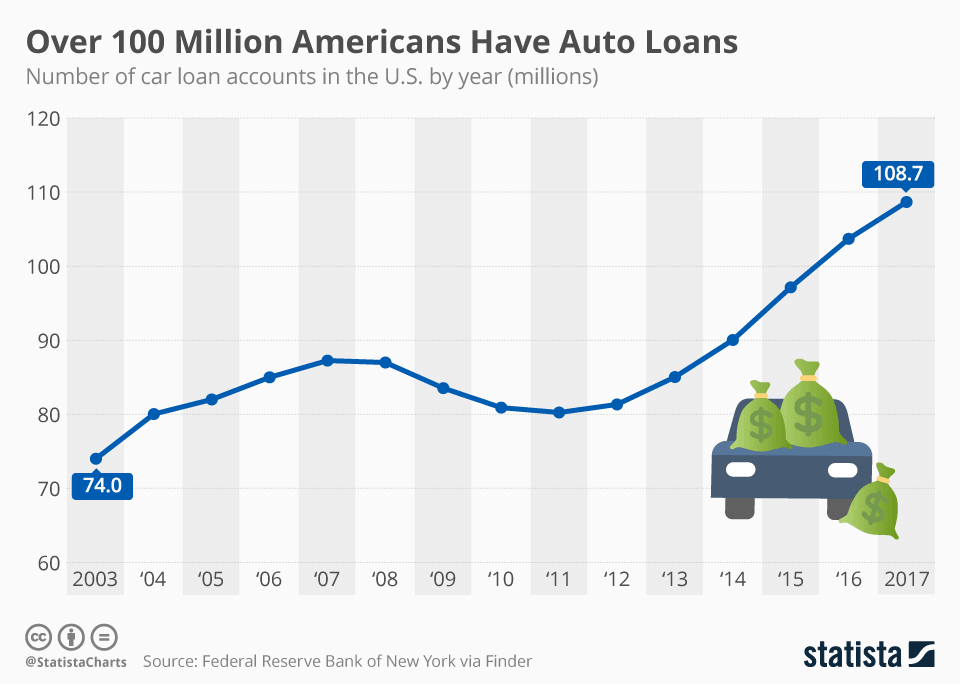

According to Statista.com, the number of car loan accounts has steadily increased over the years, from 80 million in 2013 to 113 million in 2018. As car loans continue to be a popular way for consumers to purchase vehicles in the United States, it is important for car buyers to conduct a thorough check for any liens on the vehicle before making a purchase.

What is a Lien Check?

A lien check is a process of verifying whether a vehicle has any liens attached to it. A lien is a legal claim on a property, in this case a vehicle, by a creditor or lender who is owed money. When a vehicle is purchased with a loan, the lender may place a lien on the vehicle until the loan is paid off. The lien gives the lender the right to take possession of the vehicle if the borrower fails to make payments.

A lien check can help prospective buyers or sellers of a vehicle to determine if there are any outstanding liens on the vehicle. It’s important to know about any liens on a vehicle before buying or selling it because the lien holder has a legal claim to the vehicle and could repossess it if the lien is not satisfied.

A lien check can help prospective buyers or sellers of a vehicle to determine if there are any outstanding liens on the vehicle. It’s important to know about any liens on a vehicle before buying or selling it because the lien holder has a legal claim to the vehicle and could repossess it if the lien is not satisfied.

How do you check if a vehicle has a lien on it?

A lien check can be done by contacting the DMV or by using an online service such as

VinAudit.com that specializes in vehicle history reports. The report will show any liens on the vehicle, as well as other important information such as the vehicle’s registration history, accident history, and mileage.

According to recent data from Experian, a consumer credit reporting company, the top ten states in the United States with the highest number of open auto loans accounts are:

If you want more information about Texas DMV lien check, NYS DMV lien check, California lien check or any specific state, you can use the VinAudit.com DMV lien Check above or visit your DMV website directly.(links provided below).

- Texas – 7,994,026

- California – 7,469,249

- Florida – 4,656,409

- New York – 3,621,326

- Pennsylvania – 2,952,636

- Illinois – 2,901,567

- Ohio – 2,800,168

- Georgia – 2,673,137

- Michigan – 2,614,597

- North Carolina – 2,461,630

If you want more information about Texas DMV lien check, NYS DMV lien check, California lien check or any specific state, you can use the VinAudit.com DMV lien Check above or visit your DMV website directly.(links provided below).

Car Liens Frequently Asked Questions

What happens if there is a lien on a car I want to buy?

If there is a lien on a car you want to buy, you should first try to negotiate with the seller to have the lien paid off before the sale. Alternatively, you may need to obtain a lien release from the lienholder before transferring ownership of the vehicle to you.Can I sell a car with a lien on it?

Technically, you can sell a car with a lien on it, but you will need to pay off the lien before the sale can be completed. If you are unable to pay off the lien, you may need to negotiate with the lienholder to have the lien released or seek legal advice.How do I remove a lien from a car?

To remove a lien from a car, you will need to pay off the outstanding loan amount to the lienholder. Once the loan is paid off, the lienholder should provide a lien release or satisfaction document, which you can then present to your state’s DMV to remove the lien from the vehicle’s title.How Does a Lien Affect Your Car Insurance?

When you have a lien on your car, the lienholder will require you to maintain a certain level of car insurance coverage, such as comprehensive and collision coverage, to protect their financial interest in the vehicle. This means that you will be required to include the lienholder as a named insured or loss payee on your car insurance policy. If you let your car insurance lapse, the lienholder may purchase insurance on your behalf and add the premium cost to your car loan balance, which can increase your monthly car payment.How Does a Lien Affect Your Car Title?

A lien on a car title means that the lender has a legal right to the vehicle until the debt is repaid in full. This means that you cannot sell the car or transfer the title to someone else until the lien is satisfied.If you try to sell the car while there is still a lien on the title, the lender will have to be paid first before you can transfer the title to the buyer. This is because the lien holder has a legal right to the vehicle until the debt is repaid.